Disclosure: I am long SU, EPD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Suncor Energy (NYSE: SU) became Canada's largest integrated oil company after its 2009 merger with Petro-Canada, a blockbuster deal that included additional acreage in western Canada's oil sands, as well as refineries and a portfolio of international upstream assets. The energy behemoth operates three primary business segments: refining and marketing (60 percent of 2011 revenue), oil sands (28 percent), and international and offshore (12 percent).

In the past, our investment thesis for Suncor Energy has focused primarily on the firm's oil-weighed production mix and potential to grow output significantly from its assets in Canada's oil sands, an operation that accounted for 46 percent of the company's 2011 net income. Suncor Energy's presence in the Alberta oil sands dates back to the 1960s, when the firm pioneered the first commercial-scale mining operation.

Oil-sands deposits contain bitumen, a heavier hydrocarbon that must be blended with a lighter product such as condensate or processed into a synthetic crude oil before entering the pipeline network for delivery to end-markets.

Producers extract the bitumen in one of two ways. Shallow deposits of the viscous hydrocarbon (about 20 percent of Canada's reserves, according to the Oil Sands Developers Group) can be exploited via pick-and-shovel mining. Oil sands located more than 80 meters (about 260 feet) below the surface require in situ production techniques that usually involve pumping steam into the formation to increase reservoir pressure and heat the bitumen until the hydrocarbon can be pumped to the surface.

In both instances, the extracts undergo processing to remove water, sand and other contaminants from the bitumen, after which the output is diluted with lighter products or upgraded into synthetic crude oil for transport to the marketplace. Much of these diluents come from gas-processing plants in western Canada and Enbridge's (TSX: ENB, NYSE: ENB) Southern Lights pipeline in the Midwest U.S., though additional import capacity has been proposed.

In the near term, Suncor Energy will continue to benefit from rising in situ output at the Firebag project, the first phase of which came onstream in 2004 and the second stage of which flowed first oil in 2006.

Suncor Energy's oil-sands segment posted record quarterly production of more than 340,000 barrels of oil equivalent per day in the three months ended Sept. 30, 2012, driven by infill drilling at Firebag 1 and Firebag 2, as well as a faster-than-expected increase in production from the third phase of the project.

These results are even more impressive when you consider that planned maintenance at the McKay River development and one of the firm's upgraders- a facility that transforms bitumen into synthetic crude oil-constrained output.

The company also achieved the goal of reducing its average production costs in the oil sands to less than USD35 per barrel, an accomplishment that management attributed to initiatives to improve the reliability of its operations and efficiencies associated with higher throughput. Suncor Energy's 2013 guidance calls for cash costs to average between USD33.50 per barrel and USD36.50 per barrel.

With Firebag 4 slated to begin steaming in the fourth quarter and output expected to ramp up to 60,000 barrels of oil per day in 2013, management forecasts that Suncor Energy will extract between 350,000 and 380,000 barrels of oil equivalent per day from the oil sands- an increase of about 12 percent. The company's guidance calls for overall output to increase by approximately 8 percent next year, to between 570,000 and 620,000 barrels of oil equivalent per day.

Equally important, Suncor Energy will deliver the fourth stage of its Firebag development roughly three months ahead of schedule at a price tag that's about 10 percent less than the announced budget- welcome news at a time when labor and other costs associated with oil-sands projects are on the rise.

Suncor Energy has amassed about 7.1 billion barrels of oil equivalent in proved, probable reserves- a resource base that equates to about 35 years of output at the company's 2011 production rate. Factor in the firm's estimated 21.9 billion barrels of oil equivalent in contingent resources, 19.2 billion barrels of which are in the oil sands, and you get a sense of the company's potential to grow production over the long term.

The company's current forecast calls for Suncor Energy to expand its overall hydrocarbon output at an average annual rate of 8 percent through 2020, though management's recent comments and the capital budget for 2013 suggest that the firm may adjust its near-term project lineup to reflect changing market conditions.

After the completion of Firebag 4, Suncor Energy will have four growth projects approaching final investment decisions:

- Hebron: A heavy-oil project offshore Newfoundland and Labrador in which Suncor Energy owns a 22.7 working interest. Management expects to make a final investment decision on this joint venture by year-end, with first oil slated from this conventional field for 2017.

- Fort Hills Oil Sands Project: This joint venture with Focus List holding Total (Paris: FP, NYSE: TOT) and Teck Resources (TSX: TCK/A, TCK/B; NYSE: TCK) will extract bitumen via pick-and-shovel mining. Suncor Energy holds a 40.8 percent operating interest in the project, and management has indicated that a final investment decision will be made at some point in 2013.

- Joslyn Oil Sands Project: Suncor owns a 36.75 percent working interest in this Total-operated mining project, which is expected to have a productive capacity of 100,000 barrels per day. A final investment decision is slated for 2013.

- Voyageur Upgrader: This joint venture with Total would add 200,000 barrels of capacity to process bitumen from the Fort Hills and Joslyn mining projects into higher-value synthetic crude oil and diesel fuel. Management indicated that a final investment decision would occur in 2013.

During a conference call to discuss Suncor Energy's third-quarter results, management indicated that the economics on Fort Hills and Joslyn still appear worthwhile. The firm and its partners analyze how to maximize value from these projects by lowering construction costs and ensuring solid execution. We wouldn't be surprised if Suncor Energy were to extend the timeline for these projects; management already revealed that the estimated start date for Fort Hills by at least a year.

At the same time, management acknowledged what Wall Street analysts have expected for some time: "[That] Voyageur economics appear challenged in light of the projected ramp-up in tight oil production in the North American market." Rising oil production from the Bakken Shale and other U.S. unconventional plays has pressured upgrading margins, which hinge on the spread between the price of bitumen and the market value of synthetic crude oil.

Fellow oil-sands operator Canadian Natural Resources (TSX: CNQ, NYSE: CNQ) and joint-venture partner North West Upgrading on Nov. 9 approved a USD5.7 billion investment in an upgrader that will process bitumen into low-sulfur diesel fuel and other petroleum products. However, the project's economics received a boost from the Alberta government, which agreed to supply 75 percent of the plant's feedstock from hydrocarbons that producers transfer to the province as royalty payments.

Although CEO Steven Williams and his management team assiduously avoided any definitive hints about the future of the USD11.6 billion Voyageur Upgrader, the lack of positive comments strongly suggests that the project could be postponed. Management will make a final investment decision on the endeavor at the end of the first quarter.

These potential delays suggest that management is following through with Suncor Energy's stated strategy of "capital discipline." Williams highlighted this renewed focus during a conference call to discuss the company's second-quarter results:

Growth for the sake of growth doesn't interest me too much. What interests me is profitable growth. So that leads me to my second point: a rigorous scrutiny on capital discipline. So together with the leadership team, I will examine our spending to ensure that we're laying down that capital effectively and we're achieving our desired returns for shareholders. So we plan to spend within our means and we plan to spend efficiently and effectively. Thirdly, I believe that when it comes to growth, big capital programs are not the only means of increasing production. I believe we can achieve significant growth simply by running our assets better.

Mining projects such as Fort Hills and Joslyn oil sands projects generally require oil prices of at least USD80 per barrel to generate a reasonable return on investment, making them among the highest-cost oil plays in North America. Given the recent weakness in the price of WTI, we appreciate management's abundance of caution.

In the near term, infill drilling between existing wells in the first two stages of Firebag and de-bottlenecking the first four stages should generate relatively low-cost production growth. Fellow oil-sands operators such as Cenovus (TSX: CVE, NYSE: CVE) and Meg Energy Corp (TSX: MEG, MEGEF.PK) have successfully boosted production at their in situ developments through various technical innovations; we wouldn't be surprised if Suncor Energy were to pursue similar initiatives.

Investors could also benefit from Suncor Energy temporarily reining in spending on major growth projects. In the conference call to discuss the company's second-quarter earnings, CEO Steven Williams highlighted this breather in capital investment as an opportunity to repurchase shares and potentially increase the dividend:

For the first time in our history, we're in a position not only to grow production significantly, but also to steadily grow the cash we return to shareholders. We've built a balance sheet that has demonstrated our ability to fund our growth program while also funding significant dividend increases and share buybacks, and of course, that's unprecedented for Suncor.

Although a higher dividend payout wouldn't transform Suncor Energy from a growth story to an income play overnight, such a move could serve as an upside catalyst for the stock.

Suncor Energy is also uniquely positioned among oil-sands operators to weather volatile oil prices- a quality that's likely to find favor with investors in these uncertain times.

At the recent Bank of America Merrill Lynch Global Energy Conference, management noted that the company's internal model indicates that the firm could still maintain its dividend and fund its growth projects if WTI crude oil were at USD65 per barrel for 24 months and its oil-sands operations suffered a major outage.

Much of this resilience stems from Suncor Energy's integrated operations. Some investors groused at the merger between Suncor Energy and Petro-Canada because the newly acquired downstream operations and conventional oil and gas properties diluted the combined company's exposure to the oil sands.

But this controversial transaction gave Suncor Energy the option to ramp up production at its conventional offshore properties, including the initial development of the Golden Eagle Area in the U.K. portion of the North Sea and the Hebron project off Canada's East Coast. These projects, along with Suncor Energy's existing low-cost offshore and international operations, provide exposure to Brent crude oil.

At the same time, the company's downstream assets provide a welcome hedge against the weaker price of WTI crude oil and West Canada Select (WCS), a heavy-oil benchmark that's delivered to Hardisty, Alberta. In this pricing environment, three of the firm's four refinery complexes have reaped impressive returns by processing discounted WTI crude oil and selling the resulting products at international prices.

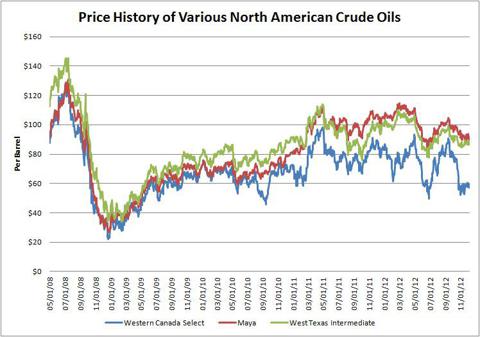

(click to enlarge)

Source: Bloomberg

The price weakness in WTI and WCS crude oil reflects temporary downstream and midstream capacity constraints.

In late October and early November, TransCanada (TSX: TRP, NYSE: TRP) reduced throughput on its Keystone pipeline, which transports oil from western Canada to Illinois, to investigate whether the system had sprung a leak. Fellow midstream operator Enbridge likewise announced that an excess of demand had forced the firm to ration capacity on one of its pipelines that stretches from western Canada to the Midwest.

Meanwhile, BP (LSE: BP, NYSE: BP) curtailed operations at its refinery in Whiting, Ind., for maintenance and repairs prior to a planned expansion of the facility that will come onstream in mid-2013. Designed to process lower-quality grades of crude oil, this facility refines large volumes of imported WCS.

Pipeline bottlenecks and reduced throughput at Whiting will ensure that the differential between the price of WCS and WTI remains elevated in the near term. However, we expect this spread to tighten in 2013, when BP's upgraded Whiting facility comes onstream and Marathon Petroleum Corp (NYSE: MPC) completes an expansion to its refinery outside Detroit.

Investors are likely more familiar with the challenges in the midstream segment.

Rising production of light, sweet crude oil from the Bakken Shale and other unconventional plays in the U.S. has glutted the hub in Cushing, Okla., the delivery point for West Texas Intermediate (WTI) crude oil. This unforeseen development has depressed WTI prices, widening the difference between the North American benchmark and varietals such as Brent crude oil that reflect supply-demand conditions in the international market.

A similar trend is developing north of the border. According to the most recent estimates from the Canadian Association of Petroleum Producers (CAPP), oil-sands output will increase to 2.3 million barrels per day in 2015- a 44 percent increase from the 1.6 million barrels per day produced in 2011. A growing slate of expansion and development projects likewise prompted CAPP to increase its production forecast for the oil sands by about 100,000 barrels per day through 2020 and 480,000 barrels per day from 2025.

The trade organization expects these production gains to drive Canada's total oil output to 3.8 million barrels per day in 2015, compared to about 3 million barrels of oil per day in 2011. Meanwhile, BP's Statistical Review of World Energy 2012 pegs Canada's oil consumption at about 2.2 million barrels of oil per day, a figure that's unlikely to increase dramatically.

Producers expect to export much of Canada's excess output to the U.S., where downstream operators have made significant investments to expand their Midwestern refineries' capacity to process heavy crude oils by about 575 million barrels, or 1.57 million barrels per day. Excess exports would flow to the Gulf Coast, displacing shrinking supplies of heavy crude oils from Mexico and Venezuela.

The divergence in price between WSC and Mexico's Maya heavy crude oil blend likewise stems in part from pipeline constraints- namely, the massive imbalance between inbound capacity to Cushing and a shortage of outbound capacity, which prevents Canadian production from reaching the Gulf Coast refinery complex.

Midstream and downstream constraints have dampened the price of WTI to less than the price of Maya heavy crude oil - an inferior varietal - and depressed the price of WSC even further.

We expect some of this effect to dissipate in 2013, when Enbridge and holding Enterprise Products Partners LP (NYSE: EPD) expand the capacity of their reversed Seaway pipeline to 400,000 barrels per day from 150,000 barrels per day. The partners also plan to build a twin pipeline that would add another 400,000 barrels per day of capacity.

These challenges aren't lost on U.S. investors, many of whom have watched with interest as U.S. lawmakers turned the approval of TransCanada Corp's Keystone XL Pipeline into a political football. This proposed 1,897-mile system would transport heavy crude oil from Hardisty to Steel City, Neb., where interconnecting pipelines would move these barrels to Midwest and Gulf Coast refiners. Keystone XL, along with other potential release valves, would help to balance the Canadian market in coming years.

The oil-sands industry has also targeted emerging-market Asia as another destination for heavy-oil exports, a move that makes sense given the substantial investments by China's national oil companies in Canada-based energy assets. (See the Dec. 2 Graph of the Week, China's National Oil Companies on Spending Spree).

Enbridge's controversial Northern Gateway Project includes an oil pipeline with nameplate capacity of 525,000 barrels per day that would transport diluted bitumen from Edmonton, Alberta, to Kitimat, British Columbia, for export to Asia. Fierce local opposition to this project has prompted industry participants to push back the expected start date to 2019.

Meanwhile, Kinder Morgan Energy Partners LP (NYSE: KMP) earlier this year announced a USD4.1 billion plan to expand the capacity of its Trans Mountain pipeline to 750,000 barrels of oil per day from 300,000 barrels of oil per day. This system transports output from Alberta's oil sands to the Port of Vancouver on Canada's Pacific Coast. Management expects the project to be completed in 2018.

With the timing of production growth unlikely to match up with the construction of additional midstream capacity, Suncor Energy's refining assets will continue to stabilize the firm's cash flow during this period of fluctuating oil-price differentials.

We also see additional upside for this operating segment if the company follows through with upgrades to its refinery in Montreal that would enable the facility to process heavy crude oil. Such a move would enable the company to take advantage of pipeline reversals aiming to transport oil the East Coast. At present, the Montreal refinery sources the majority of its input at prices indexed to Brent crude oil.

The Verdict

Suncor Energy's impressive asset base in Canada's oil sands provides plenty of long-term growth potential, while the firm's refinery assets insulate its cash flow from lower WTI and WSC oil prices. None of the other integrated operators in Canada's oil sands can match this natural hedge. Meanwhile, the option to ramp up production offshore Canada and in international markets provides a near-term alternative to outsized investments in major oil-sands projects.

Well-positioned to weather the inevitable fluctuations in North American oil-price differentials, Suncor Energy remains our favorite play on Canada's oil sands-the potential for a dividend increase sweetens the deal and provides a near-term upside catalyst.

Source: http://seekingalpha.com/article/1059511-the-case-for-investing-in-suncor-energy

james jones james jones aladdin black forest ufc 144 fight card ufc 144 results acura nsx

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.